Read next

Accurately Predict Consumer Default Risk

Make the Loan Journey Easier for the Right Customers

Read Article

A US based financial lending institution needed to improve the accuracy of business credit risk evaluation by more successfully identifying businesses that are more likely to default during the loan origination process.

By combining the Powerlytics Data Platform with the financial institutionâs loan-level business data file, we were able to identify the business and consumer (Schedule C) tax return variables that have significant predictive power between the default and non-default populations.

Once identified, these variables can be leveraged in predictive models, scores or indexes for a variety of purposes, including:

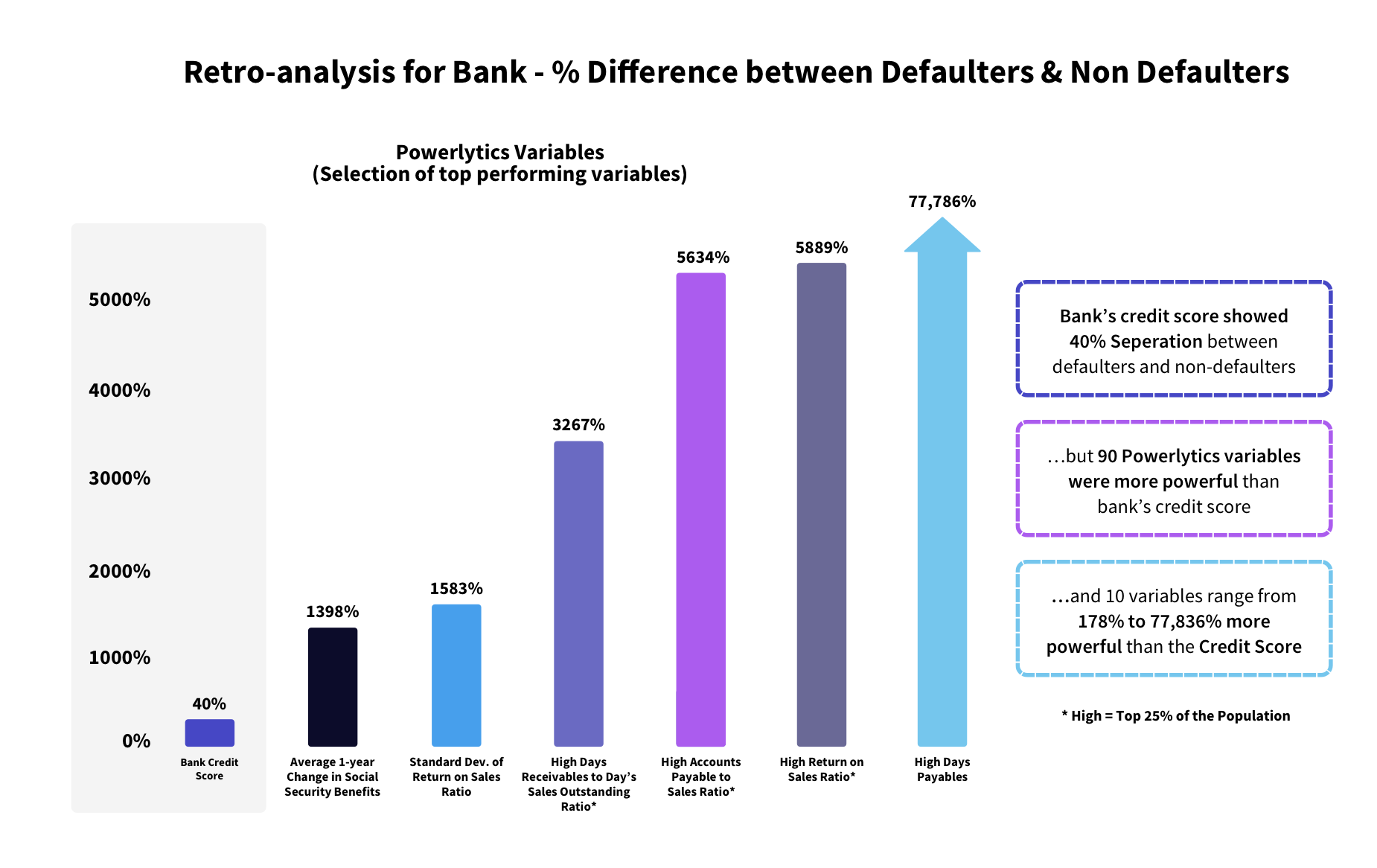

The Powerlytics variables show significant predictive power when compared to the customerâs business credit score. Specifically, Powerlytics had 90 tax variables that were more powerful than the business credit score.

The Top 10 of these variables range from 178% to 77,836% more powerful than the business credit score in separating businesses that default from businesses that do not default.Â

Please note that the average differences above are across multiple business credit score bands. For example, the average difference of the business credit score for defaulters vs. non-defaulters was 40% while the average difference between those populations for the Powerlytics variable âHigh Dayâs Payablesâ was 77,876%. In other words, there was almost a 2,000 times difference in the predictive power between the business credit score and the Powerlytics data variable.

Make the Loan Journey Easier for the Right Customers

Read Article